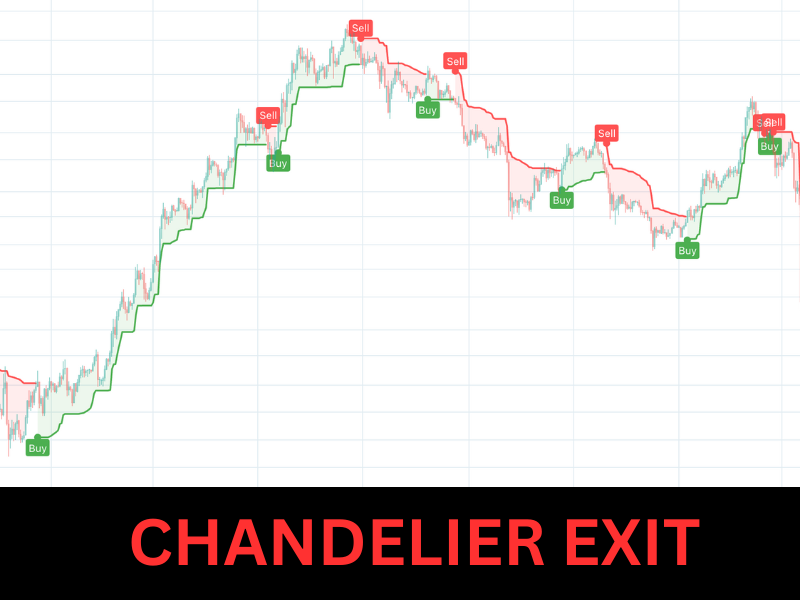

Chandelier Exit Trading Strategy : For Those who don’t want to miss any move.

The Chandelier Exit trading strategy is a popular and dynamic approach used by traders to manage their positions and set stop-loss levels. Developed by Chuck LeBeau, the Chandelier Exit is designed to adapt to market volatility, providing a flexible mechanism for protecting gains and limiting losses.

At its core, the Chandelier Exit is based on a volatility-based trailing stop. The strategy takes into account the Average True Range (ATR), a measure of market volatility, to determine the distance between the current price and the trailing stop level. The Chandelier Exit sets a stop-loss level at a multiple of the ATR below the highest high since entering a long position or above the lowest low since entering a short position. This way, the stop level adjusts dynamically to changes in market volatility, allowing for wider stops during volatile periods and tighter stops during calmer market conditions.

Traders employing the Chandelier Exit strategy benefit from a balance between allowing the trade enough room to breathe and protecting against significant adverse moves. The strategy is particularly useful in trending markets, where it helps traders stay in a trend while avoiding premature exits. By incorporating market volatility into the stop-loss calculation, the Chandelier Exit adapts to the ever-changing nature of financial markets, offering a systematic and disciplined approach to risk management.

Overall, the Chandelier Exit trading strategy is a valuable tool for traders seeking a dynamic and adaptive method to control risk and optimize their trade management in various market conditions.

Here is the link to redesigned version of Chandelier Exit on tradingview

Advantages of Chandelier Exit

- Adaptability to Market Volatility: One of the primary advantages of the Chandelier Exit trading strategy is its ability to adapt to changing market conditions. By incorporating the Average True Range (ATR) in the calculation, the strategy adjusts the trailing stop levels based on current volatility. This adaptability allows traders to set wider stops during periods of increased volatility and tighter stops when the market is calmer, providing a more dynamic and responsive risk management approach.

- Trend Following Capability: The Chandelier Exit is particularly effective in trending markets. It enables traders to stay in a trend for a more extended period by dynamically adjusting the stop-loss levels. This feature helps traders capture the full potential of a trend while minimizing the risk of premature exits, which can be a common challenge in trend-following strategies.

- Systematic Risk Management: The strategy provides a systematic and rule-based approach to risk management. Traders can set their stop-loss levels objectively based on market conditions and predefined parameters, reducing the influence of emotions in decision-making. This systematic approach contributes to consistency and discipline in trading.

- Protection of Profits: The Chandelier Exit is designed to protect profits by preventing traders from holding onto a position for too long in the face of a potential reversal. As the trailing stop dynamically adjusts to the market’s movements, it locks in gains by automatically raising the stop level during an uptrend or lowering it during a downtrend.

- Simplicity and Accessibility: Implementing the Chandelier Exit strategy is relatively straightforward, making it accessible to both novice and experienced traders. The reliance on the ATR and a few predefined parameters simplifies the decision-making process for setting stop-loss levels. This simplicity can be advantageous, especially for traders who prefer a clear and uncomplicated approach to managing risk in their trades.